The Only Guide for Real Estate Reno Nv

Unknown Facts About Real Estate Reno Nv

Table of ContentsThe Main Principles Of Real Estate Reno Nv Rumored Buzz on Real Estate Reno NvReal Estate Reno Nv Things To Know Before You BuyAll About Real Estate Reno Nv8 Simple Techniques For Real Estate Reno NvThe Basic Principles Of Real Estate Reno Nv

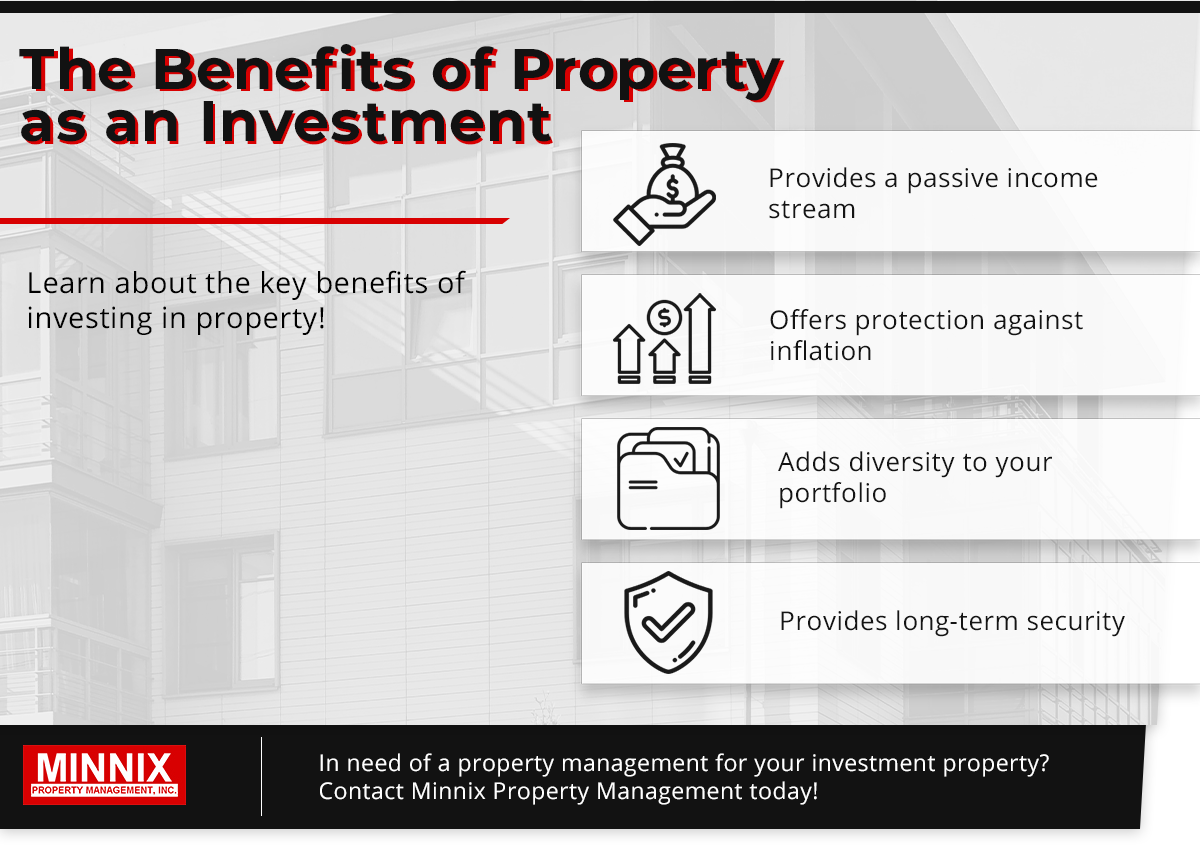

The advantages of spending in genuine estate are various (Real Estate Reno NV). With well-chosen assets, investors can enjoy predictable money flow, exceptional returns, tax obligation benefits, and diversificationand it's possible to leverage property to build wide range. Believing regarding spending in property? Here's what you need to find out about actual estate advantages and why genuine estate is thought about an excellent financial investment.

The benefits of purchasing genuine estate consist of easy revenue, secure capital, tax obligation benefits, diversity, and utilize. Property investment company (REITs) supply a means to purchase actual estate without having to own, run, or finance properties. Cash money flow is the internet revenue from a property investment after home loan repayments and business expenses have actually been made.

Actual estate worths often tend to boost gradually, and with a good financial investment, you can transform a revenue when it's time to offer. Rental fees also often tend to rise with time, which can lead to higher capital. This graph from the Federal Book Bank of St. Louis reveals median home rates in the U.S

The Definitive Guide for Real Estate Reno Nv

The locations shaded in grey show united state economic crises. Mean List Prices of Residences Offered for the USA. As you pay for a property mortgage, you develop equityan property that belongs to your total assets (Real Estate Reno NV). And as you build equity, you have the take advantage of to purchase more buildings and increase cash flow and wide range much more.

Property has a lowand in some cases negativecorrelation with other major property classes. This implies the addition of realty to a profile of varied assets can decrease profile volatility and offer a higher return each of danger. Leverage is the usage of various economic instruments or borrowed capital (e.

Real Estate Reno Nv Fundamentals Explained

As economic situations expand, the demand for genuine estate drives rents higher. This, subsequently, equates into greater funding values. Consequently, realty tends to keep the acquiring power of capital by passing a few of the inflationary pressure on tenants and by incorporating several of the inflationary pressure in the kind of capital admiration.

There are a number of ways that possessing genuine estate can safeguard against rising cost of living. Second, rental fees on investment homes can enhance to maintain up with rising cost of living.

Nevertheless, one can make money from marketing their home at a cost higher than they spent for it. And, if this does take place, you may be responsible to pay tax obligations on those gains. In spite of all the advantages of purchasing actual estate, there are disadvantages. One of the major ones is the lack of liquidity (or the loved one trouble in converting a property into money and cash right into a property).

Not known Incorrect Statements About Real Estate Reno Nv

Among the most basic and most usual methods is just acquiring a home to rent out to others. So why Check Out Your URL invest in realty? It requires much more work than merely clicking a few buttons to spend in a common check over here fund or stock. The reality is, there are several property advantages that make it such a prominent selection for seasoned capitalists.

Yet the rest goes to paying down the financing and building equity. Equity is the worth you have in a building. It's the difference in between what you owe and what the residence or land is worth. Over time, regular settlements will eventually leave you having a residential property cost-free and clear.

Getting My Real Estate Reno Nv To Work

Any person who's shopped or filled their storage tank lately recognizes exactly how inflation can destroy the power of hard-earned cash. Among the most underrated property benefits is that, unlike many typical investments, realty worth has a tendency to rise, even during times of remarkable inflation. Like other important possessions, actual estate often maintains worth and can for that reason operate as an excellent area to invest while higher prices gnaw the gains of various other financial investments you might have.

Admiration refers to money made when the total value of a property rises in between the time you buy it and the moment you offer it. For genuine estate, this can indicate considerable gains due to the normally high rates of the possessions. However, it's critical to bear in mind gratitude is a single thing and only supplies cash when you sell, not in the process.

As discussed previously, cash money flow is the money that comes on a month-to-month or annual basis as an outcome of having the property. Usually, this is what's left over after paying all the needed expenditures like home mortgage payments, repairs, taxes, and insurance policy. Some residential or commercial properties may have a significant money flow, while others might have little or none.

The 45-Second Trick For Real Estate Reno Nv

New financiers may not really comprehend the power of take advantage of, but those that do unlock the capacity for substantial gains on their investments. Usually speaking, leverage in investing comes when you can possess or manage navigate to this website a larger quantity of possessions than you could or else pay for, via making use of credit report.